Scale Your Trading Career: Moving from $10K to $200K Prop Accounts

Foreign exchange proprietary trading firms, commonly referred to as FX prop firms, present a unique landscape for traders seeking to enhance their trading careers. These firms provide capital to traders, allowing them to trade with larger sums than they might possess individually. This arrangement not only alleviates the financial burden on traders but also opens doors to potentially higher returns.

The allure of trading with a firm’s capital is particularly appealing for those who have honed their skills but lack the necessary funds to scale their operations. By leveraging the resources and infrastructure of a prop firm, traders can focus on refining their strategies and executing trades without the constant worry of personal financial risk. Moreover, FX prop firms often offer a structured environment that includes access to advanced trading tools, market research, and educational resources.

This support can be invaluable for traders looking to improve their performance and develop a deeper understanding of market dynamics. Many firms also foster a collaborative culture, where traders can share insights and strategies, further enhancing their learning experience. The combination of capital support and educational resources creates an environment ripe for growth, making FX prop firms an attractive option for both novice and experienced traders alike.

Key Takeaways

- FX prop firms offer opportunities for traders to access more capital and resources for trading.

- Scaling a trading account requires a well-defined strategy and disciplined risk management.

- Managing risk and allocating capital becomes even more crucial in larger trading accounts.

- Technology and automation can enhance trading efficiency and decision-making processes.

- Building a track record and reputation is essential for attracting future growth opportunities.

- Seeking mentorship and guidance from experienced traders can provide valuable insights and support for career development in trading.

Developing a Strategy for Scaling Your Trading Account

To successfully scale a trading account within a prop firm, it is essential for traders to develop a robust and adaptable trading strategy. This strategy should encompass various elements, including market analysis, risk management, and trade execution techniques. A well-defined approach allows traders to navigate the complexities of the forex market with confidence.

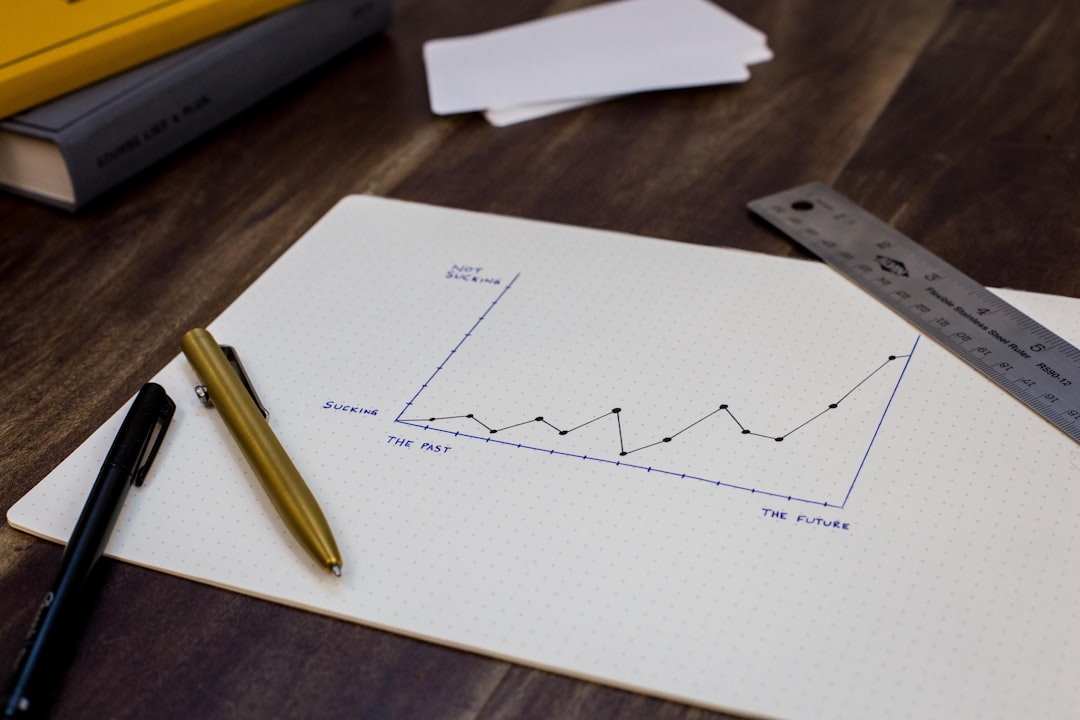

Traders must consider their trading style—whether they prefer day trading, swing trading, or position trading—and tailor their strategies accordingly. By aligning their methods with their personal strengths and market conditions, traders can maximize their potential for success. In addition to defining a trading style, traders should also focus on setting realistic goals for scaling their accounts.

This involves establishing clear performance metrics and benchmarks that can guide their progress. For instance, traders might aim for a specific percentage return on investment over a defined period or set targets for the number of successful trades executed each month. By breaking down larger objectives into manageable milestones, traders can maintain motivation and track their progress more effectively.

Furthermore, regular evaluation of their strategies and performance will enable them to make necessary adjustments and improvements, ensuring that they remain on the path to scaling their accounts successfully.

Managing Risk and Capital Allocation in a Larger Account

As traders scale their accounts within a prop firm, effective risk management becomes increasingly critical. The larger the account, the greater the potential for significant losses if trades do not go as planned. Therefore, implementing a comprehensive risk management strategy is essential for preserving capital and ensuring long-term success.

This strategy should include setting stop-loss orders, diversifying trades across different currency pairs, and determining appropriate position sizes based on account equity. By adhering to these principles, traders can mitigate risks while still pursuing profitable opportunities in the forex market. Capital allocation is another vital aspect of managing a larger trading account.

Traders must carefully consider how much capital to allocate to each trade based on their overall risk tolerance and market conditions. A common approach is to risk only a small percentage of the total account balance on any single trade—typically between one to two percent. This conservative approach helps protect against substantial losses while allowing for growth over time.

Additionally, traders should regularly review their capital allocation strategies to ensure they align with their evolving trading goals and market dynamics. By maintaining discipline in both risk management and capital allocation, traders can navigate the challenges of larger accounts with greater confidence.

Leveraging Technology and Automation for Efficiency

In today’s fast-paced trading environment, leveraging technology and automation has become essential for achieving efficiency and maximizing profitability. Many FX prop firms provide access to sophisticated trading platforms equipped with advanced analytical tools and features that can enhance decision-making processes. Traders can utilize these tools to conduct in-depth technical analysis, monitor market trends in real-time, and execute trades swiftly.

By harnessing technology effectively, traders can gain a competitive edge in the forex market. Automation also plays a crucial role in streamlining trading operations. Traders can implement algorithmic trading strategies that execute trades based on predefined criteria without requiring constant manual intervention.

This not only saves time but also reduces the emotional stress associated with trading decisions. Automated systems can analyze vast amounts of data quickly, identifying potential opportunities that may be missed by human traders. However, it is important for traders to remain vigilant and periodically review their automated strategies to ensure they are performing as intended in changing market conditions.

By embracing technology and automation, traders can enhance their efficiency and focus on refining their overall trading strategies.

Building a Track Record and Reputation for Future Growth

Establishing a solid track record is paramount for traders looking to advance within FX prop firms or attract future opportunities in the trading industry. A consistent history of profitable trades not only demonstrates a trader’s skill but also builds credibility among peers and potential investors. Traders should meticulously document their trades, including entry and exit points, reasons for taking each trade, and outcomes.

This detailed record-keeping allows them to analyze their performance over time and identify patterns or areas for improvement. In addition to maintaining a strong performance record, building a positive reputation within the trading community is equally important. Engaging with fellow traders through forums, social media platforms, or networking events can help establish connections that may lead to mentorship opportunities or collaborative ventures.

As they build their reputation, traders may find themselves presented with new opportunities for growth—whether through partnerships with other traders or invitations to participate in exclusive trading events.

Seeking Mentorship and Guidance from Experienced Traders

The journey of becoming a successful trader is often enhanced by seeking mentorship from experienced professionals in the field. Mentorship provides invaluable insights that can accelerate learning and help navigate the complexities of the forex market more effectively. Experienced traders can offer guidance on developing strategies, managing risks, and overcoming common pitfalls that novice traders may encounter.

Moreover, mentorship fosters accountability and motivation. Having someone to provide feedback on performance and encourage continuous improvement can significantly impact a trader’s development journey.

Many FX prop firms recognize the importance of mentorship and may even facilitate connections between novice traders and seasoned professionals within their networks. By actively seeking out mentorship opportunities—whether through formal programs or informal relationships—traders can enhance their skills and position themselves for long-term success in the competitive world of forex trading. In conclusion, FX prop firms offer a wealth of opportunities for traders willing to invest time and effort into developing their skills and strategies.

By understanding the unique advantages these firms provide, focusing on effective account scaling strategies, managing risk diligently, leveraging technology wisely, building a strong track record, and seeking mentorship from experienced professionals, traders can navigate the complexities of the forex market with greater confidence and success. The journey may be challenging, but with dedication and the right support system in place, traders can achieve remarkable growth in their trading careers.

FAQs

What is a prop trading account?

A prop trading account, short for proprietary trading account, is a type of trading account where the trader uses the firm’s capital to make trades, rather than their own money.

What is the typical starting capital for a prop trading account?

The typical starting capital for a prop trading account can vary, but it is common for traders to start with around $10,000.

How can a trader scale their trading career from a $10K to a $200K prop account?

Traders can scale their trading career by consistently making profitable trades, building a track record of success, and demonstrating their ability to manage larger amounts of capital.

What are some strategies for growing a prop trading account?

Some strategies for growing a prop trading account include diversifying the trading portfolio, managing risk effectively, and continuously learning and adapting to market conditions.

What are the benefits of trading with a larger prop account?

Trading with a larger prop account allows traders to take on larger positions, potentially earn higher profits, and access more opportunities in the market.

Recent Comments